2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best possible decision for your homeownership plans.

Here’s an early look at the most recent projections on mortgage rates, home sales, and prices for 2025.

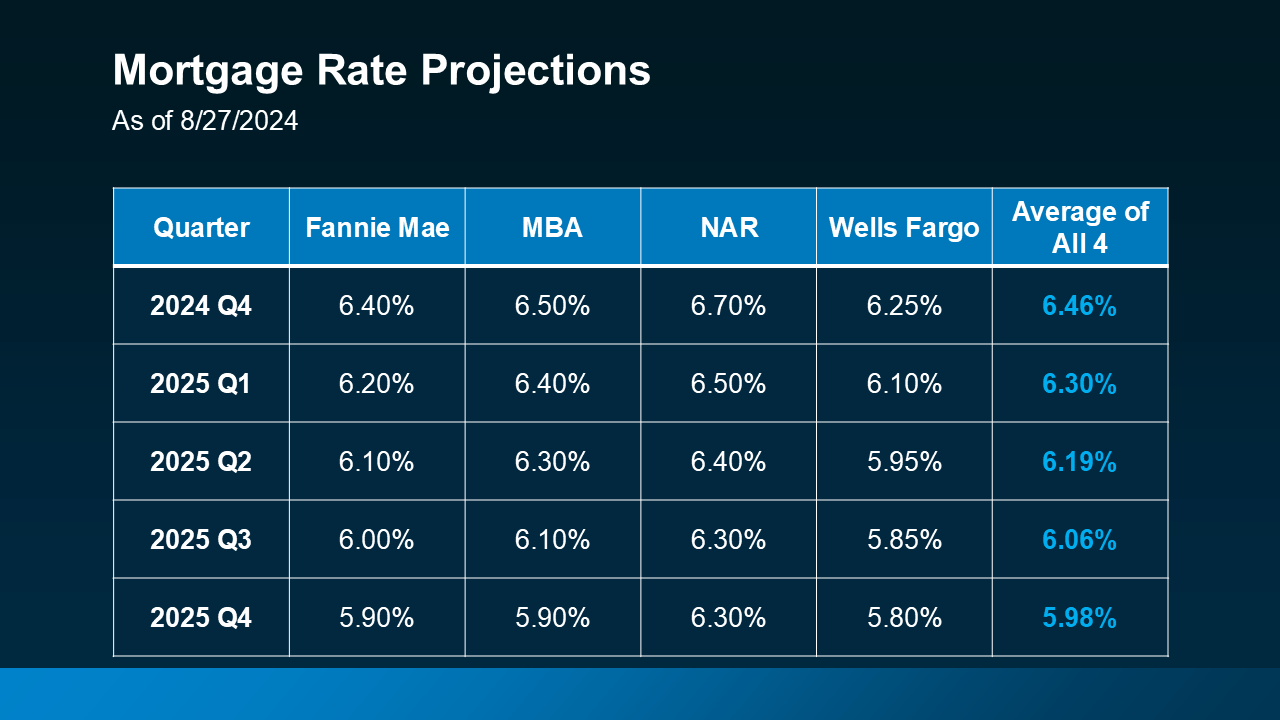

Mortgage rates play a significant role in the housing market. The forecasts for 2025 from Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo show an expected gradual decline in mortgage rates over the course of the next year (see chart below):

Mortgage rates are projected to come down because continued easing of inflation and a slight rise in unemployment rates are key signs of a strong but slowing economy. And many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which tends to lead to lower mortgage rates. As Morgan Stanley says:

Mortgage rates are projected to come down because continued easing of inflation and a slight rise in unemployment rates are key signs of a strong but slowing economy. And many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which tends to lead to lower mortgage rates. As Morgan Stanley says:

“With the U.S. Federal Reserve widely expected to begin cutting its benchmark interest rate in 2024, mortgage rates could drop as well—at least slightly.”

The market will see an increase in both the supply of available homes on the market, as well as a rise in demand, as more buyers and sellers who have been sitting on the sidelines because of higher rates choose to make a move. That’s one big reason why experts are projecting an increase in home sales next year.

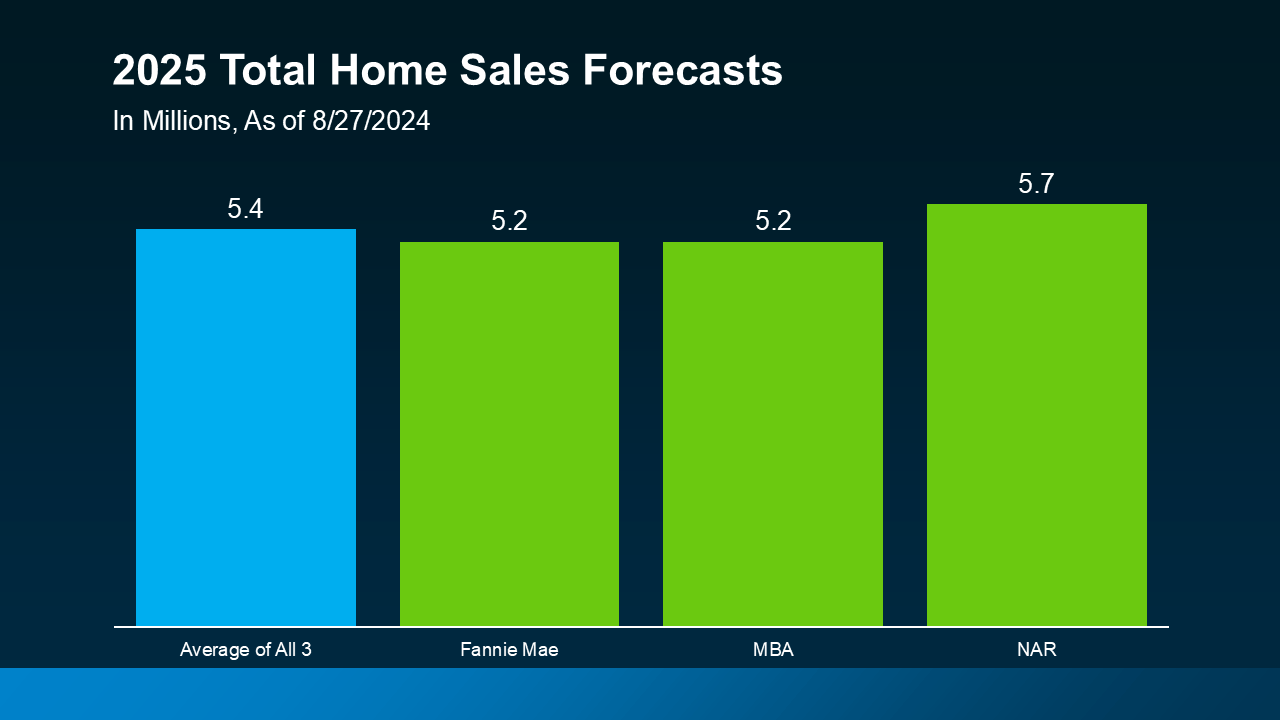

According to Fannie Mae, MBA, and NAR, total home sales are forecast to climb slightly, with an average of about 5.4 million homes expected to sell in 2025 (see graph below):

That would represent a modest uptick from the lower sales numbers in 2023 and 2024. For reference, about 4.8 million total homes were sold in 2023, and expectations are for around 4.5 million homes to sell this year.

That would represent a modest uptick from the lower sales numbers in 2023 and 2024. For reference, about 4.8 million total homes were sold in 2023, and expectations are for around 4.5 million homes to sell this year.

While slightly lower mortgage rates are not expected to bring a flood of buyers and sellers back to the market, they certainly will get more people moving. That means more homes available for sale – and competition among buyers who want to purchase them.

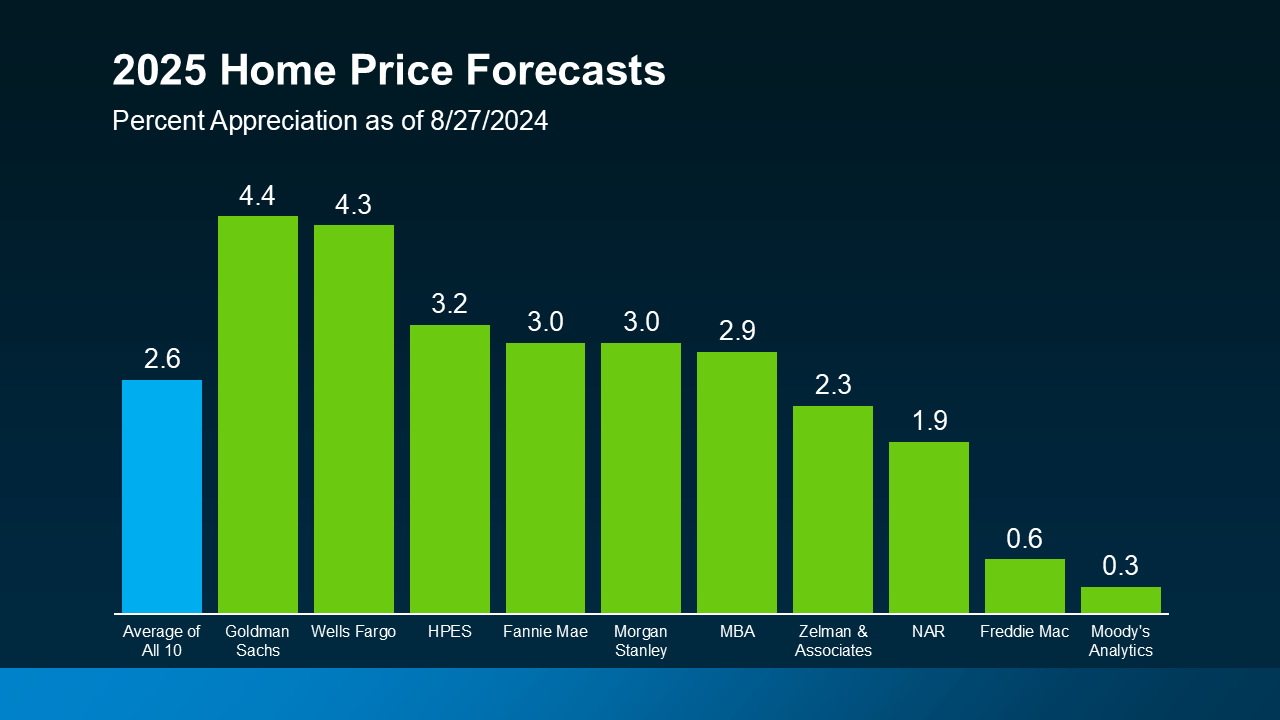

More buyers ready to jump into the market will put continued upward pressure on prices. Take a look at the latest price forecasts from 10 of the most trusted sources in real estate (see graph below):

On average, experts forecast home prices will rise nationally by about 2.6% next year. But as you can see, there’s a range of opinions on how much prices will climb. Experts agree, however, that home prices will continue to increase moderately next year at a slower, more normal rate. But keep in mind, prices will always vary by local market.

On average, experts forecast home prices will rise nationally by about 2.6% next year. But as you can see, there’s a range of opinions on how much prices will climb. Experts agree, however, that home prices will continue to increase moderately next year at a slower, more normal rate. But keep in mind, prices will always vary by local market.

Understanding 2025 housing market forecasts can help you plan your next move. Whether you're buying or selling, staying informed about these trends will ensure you make the best decision possible. Let’s connect to discuss how these forecasts could impact your plans.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.