Buying Beats Renting in 22 Major U.S. Cities

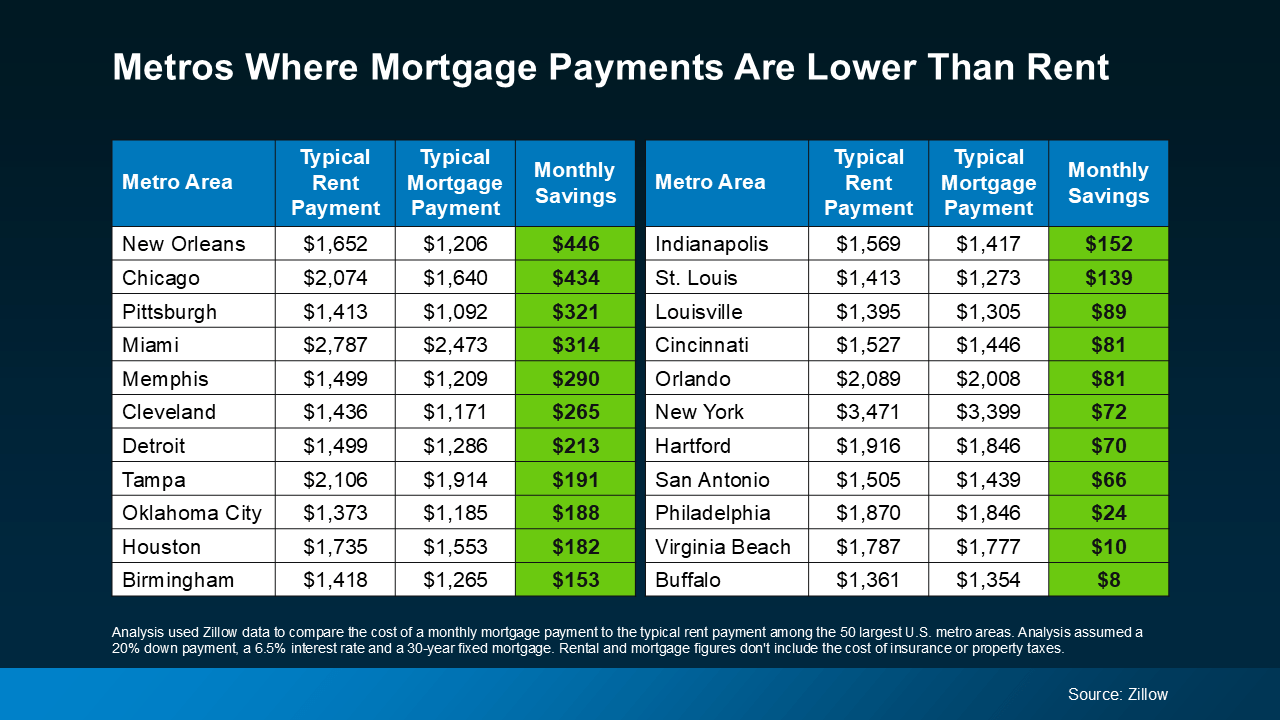

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

This is a big deal if you’ve been renting for a while now. But if you don’t see your city on this list, don’t sweat it. Things are moving fast, and your area might be joining these top metros soon.

You see, talking with a local real estate agent about what’s happening in your market before this happens in your ideal neighborhood could really change the game for you. It’s all about being informed by a true expert, and understanding what was out of reach before might actually be getting more affordable than you think.

Now, while this study compares monthly rent to principal and interest on a mortgage payment (not the whole monthly payment), let’s think through this. As Zillow notes, what you can’t ignore when you buy a home are things like taxes, insurance, utilities, and maintenance that should also be factored into your budget and your monthly payment.

But remember – renters pay extra fees too, like renters’ insurance, utilities, parking, and more. And while doing the math may feel like a drag, this equation could be a much more exciting one to work through today.

So, grab your calculator and your agent because the big takeaway is this: it may be time to determine if you’re in a spot to afford what you couldn’t just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, says:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter. With mortgage rates dropping, it's a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Whether you live in one of these budget-friendly metros where the scales have already tipped in your favor, or any town in-between, it’s time to connect with a local real estate agent to get the conversation started.

With mortgage rates coming down and more homes hitting the market, you’ll want to be ready to jump back into your search – before everyone else does.

If you’re tired of renting and ready to find out what it takes to purchase a home in our area now that the landscape may be shifting, let’s do the math together to see if buying a home makes sense for you now or sometime soon.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.