Home Values Rise Even as Median Prices Fall

Recent headlines have been buzzing about the median asking price of homes dropping compared to last year, and that’s sparked plenty of confusion. And as a buyer or seller, it’s easy to assume that means prices are coming down. But here’s the catch: those numbers don’t tell the full story.

Nationally, home values are actually rising, even if the median price is down a bit. Let’s break down what’s really happening so you can make sense of the market without getting caught up in the fear the headlines create.

The biggest reason for the dip in median price is the size of homes being sold. The median price reflects the middle point of all the homes for sale at any given time. And that’ll be affected by the mix of homes on the market.

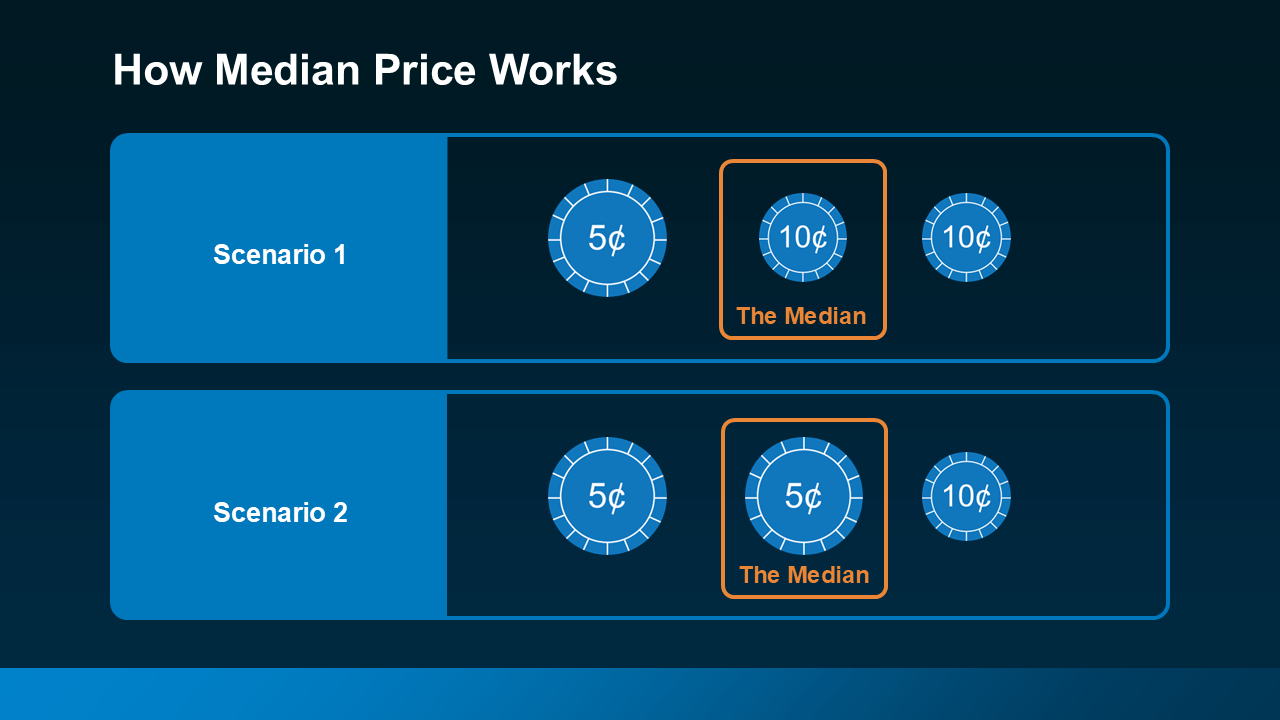

To show you how this works, here’s a simple explanation of a median (see visual below). Let’s say you have three coins in your pocket, and you decide to line them up according to their value from low to high. If you have one nickel and two dimes, the median (the middle one) is 10 cents. If you have two nickels and one dime, the median is now five cents.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change. The same is true for housing.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change. The same is true for housing.

Right now, there’s a greater number of smaller, less expensive homes on the market, and that’s bringing the overall median price down. But that doesn’t mean home values are declining.

As Danielle Hale, Chief Economist at Realtor.com, explains:

“The share of inventory of smaller and more affordable homes has grown, which helps hold down the median price even as per-square-foot prices grow further.”

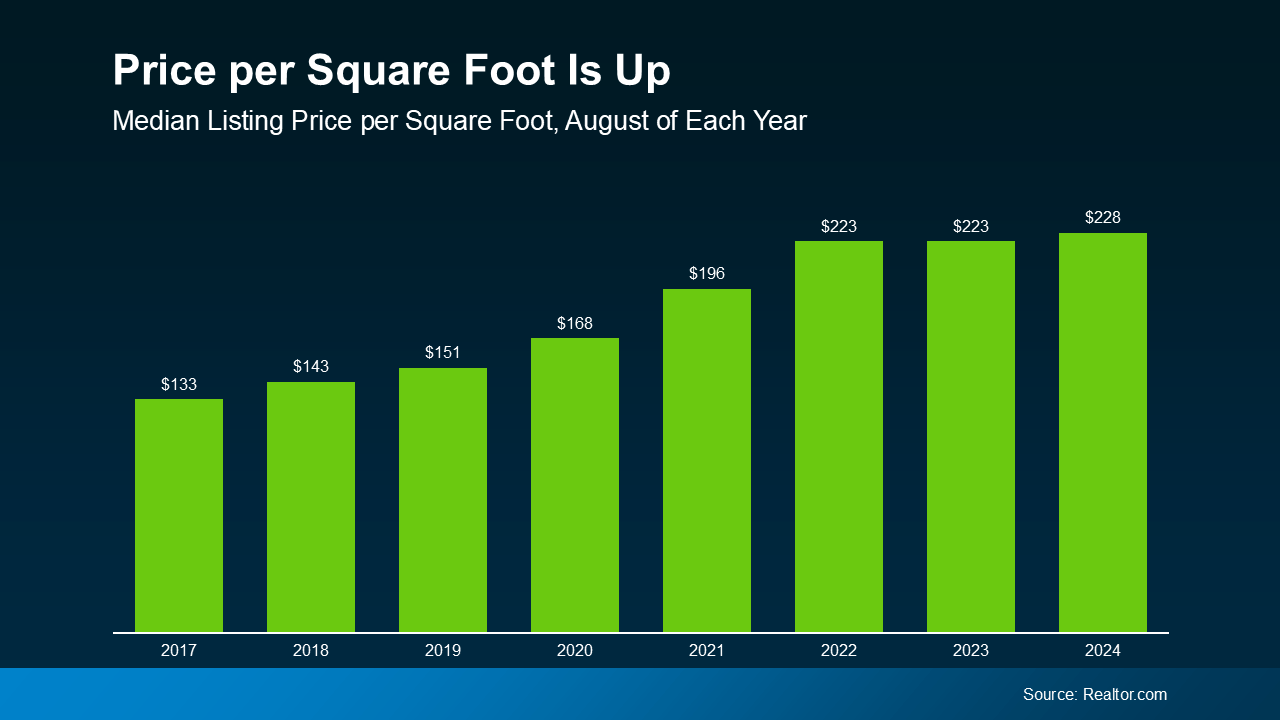

And here’s the data to prove it.

One of the best ways to measure home values is by looking at the price per square foot. That’s because it shows how much you're paying for the space inside the home.

The median asking price doesn't take into account the size of different homes, so it may not always reflect the true value. And the latest national price per square foot data shows home values are still increasing, even though the median asking price has dropped (see graph below).

As Ralph McLaughlin, Senior Economist at Realtor.com, explains:

As Ralph McLaughlin, Senior Economist at Realtor.com, explains:

“When a change in the mix of inventory toward smaller homes is accounted for, the typical home listed this year has increased in asking price compared with last year.”

This means that while smaller homes are affecting the median price, the average home’s value is still rising. According to the Federal Housing Finance Agency (FHFA):

“Nationally, the U.S. housing market has experienced positive annual appreciation each quarter since the start of 2012.”

So, while headlines may make it sound like prices are crashing, you don’t have to worry. With a closer look and more reliable data, you can see that prices are still climbing nationally.

But it’s important to remember that home prices can vary by region. While national trends provide a big-picture view, local markets may be experiencing different conditions. A trusted agent is the best resource to explain what’s happening in your area.

The decrease in median price is not the same as a decrease in home values. The median asking price is down mostly due to the mix of smaller, less expensive homes on the market.

The important thing to focus on is the price per square foot, which is a better indicator of overall market value—and those prices are still going up. If you have questions about what home prices are doing in our area, feel free to reach out.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Whether you’re buying or selling a house, here’s something to think about that most people don’t.

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. Here's why.

If you pulled your listing last year, now is the time to put it back up; with a new strategy.

If you took your house off the market in late 2024, you’re not the only one. But now, with spring fast approaching, it’s time to reassess.

With the large rise in homes available on the market, this could be your time to get in on the market.

Before you even start looking at homes, there's something you should do first: get pre-approved for your mortgage.

We've been in a seller's market for around a decade now, but the market is starting to flip. Is It balancing out?

Is the market finally balancing out? And does that mean buyers will have it a bit easier now? Here’s what you need to know.

The homebuying process has always been a mix of excitement and nerves, and that’s completely normal. Here's some information that can save you stress.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.