How Mortgage Rate Changes Impact Your Homebuying Power

If you’re thinking about buying or selling a home, you’ve probably got mortgage rates on your mind. That’s because you’ve likely heard that mortgage rates impact how much you can afford in your monthly mortgage payment, and you want to factor that into your planning. Here’s what you need to know.

Mortgage rates have been trending down recently. While that’s good news for your homebuying plans, it’s important to know that rates can be unpredictable because they’re affected by many factors.

Things like the economy, job market, inflation, and decisions made by the Federal Reserve all play a part. So, even as rates go down, they can still bounce around a bit based on new economic data. As Odeta Kushi, Deputy Chief Economist at First American, says:

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

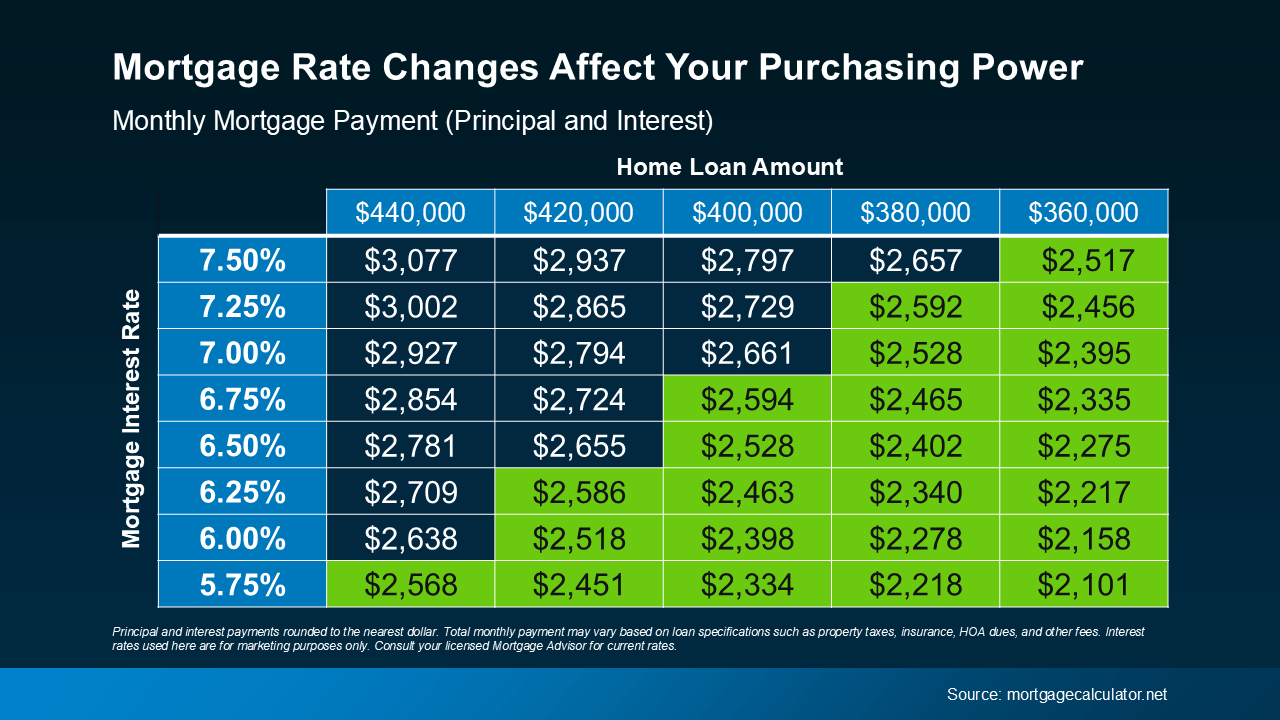

When mortgage rates change, it affects how much you pay each month for your home loan. Even a small rate change can make a big difference to your monthly bill.

Take a look at the chart below to see how different mortgage rates impact your house payment each month for various loan amounts. Imagine you can afford a monthly payment of $2,600 for your home loan. The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

Understanding how mortgage rates impact your payment helps you make better decisions.

Understanding how mortgage rates impact your payment helps you make better decisions.

Real estate agents have the expertise to help you understand what’s happening and what it means for you. They can provide tools and visuals, like the chart above, to show how rate changes impact your buying power.

You don’t need to be a mortgage expert; you just need a professional by your side. Someone who can help you make sense of the market and guide you through your homebuying or selling journey.

If you have questions about the housing market, let’s connect. That way you’ll understand what’s going on and how to navigate it.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.