Mortgage Rates Hit Lowest Point So Far This Year

If you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.

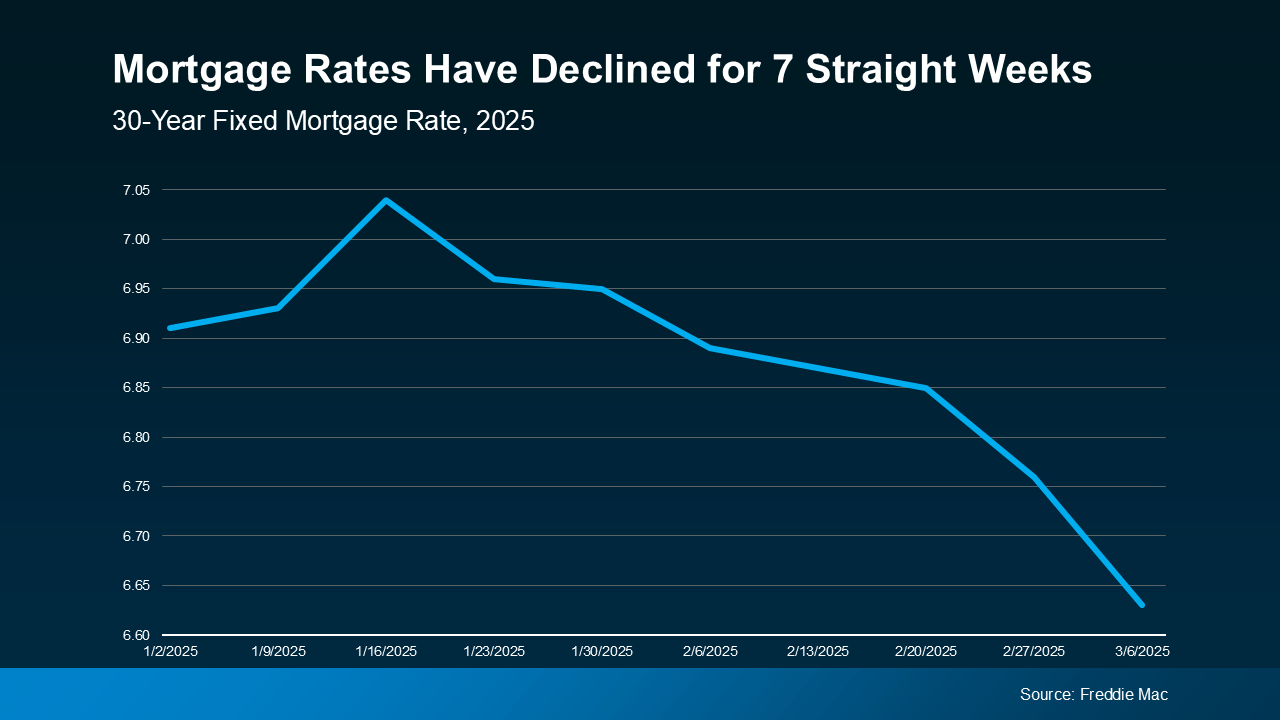

Mortgage rates have been declining for seven straight weeks now, according to data from Freddie Mac. And the average weekly rate is now at the lowest level so far this year (see graph below):

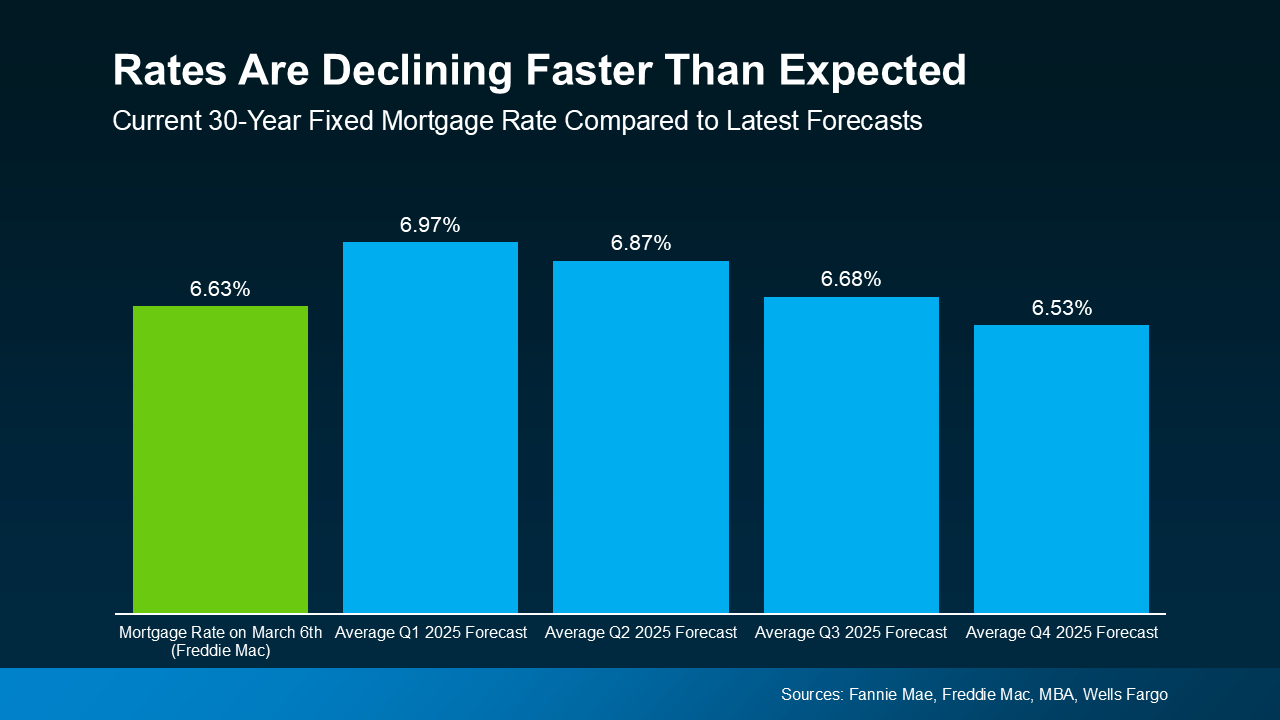

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), recent economic uncertainty is playing a role in pushing rates lower:

"Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024."

And the timing of this recent decline is great because it gives you a little bit of relief going into the spring market. Just remember, mortgage rates can be a quickly moving target, so you should expect some volatility going forward. But the window you have as they’re coming down right now might be the sweet spot for your purchasing power now.

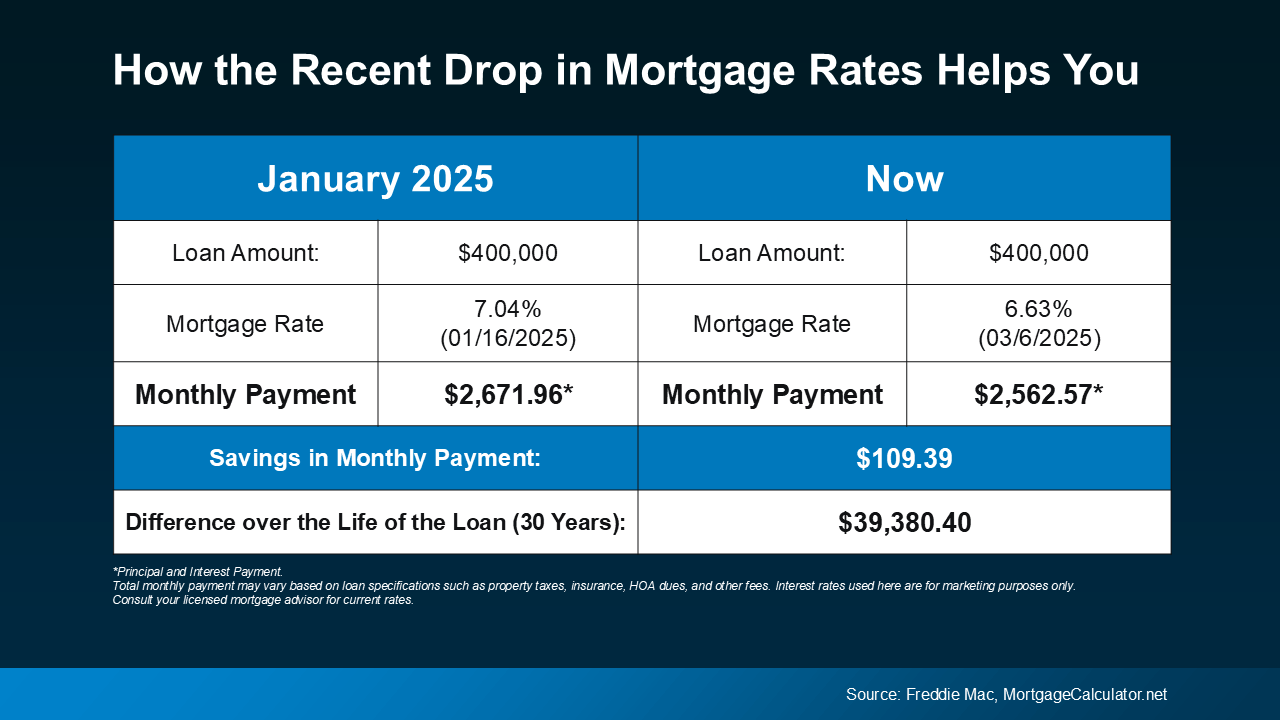

Even small changes in rates can make a difference to your monthly payment. Here’s how the math shakes out. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

Just remember, shifts in the economy drove rates down faster than expected. But that can change, making rates volatile in the days and months ahead. So, if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity if you’re ready to act.

Mortgage rates have dipped, giving buyers a bit more immediate breathing room. If you’ve been waiting for rates to ease before jumping in, this could be your window.

Would a lower monthly payment make buying a home feel more doable for you? Let’s break down the numbers and find out.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.