Should Baby Boomers Buy or Rent After Selling Their Houses?

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead?

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you.

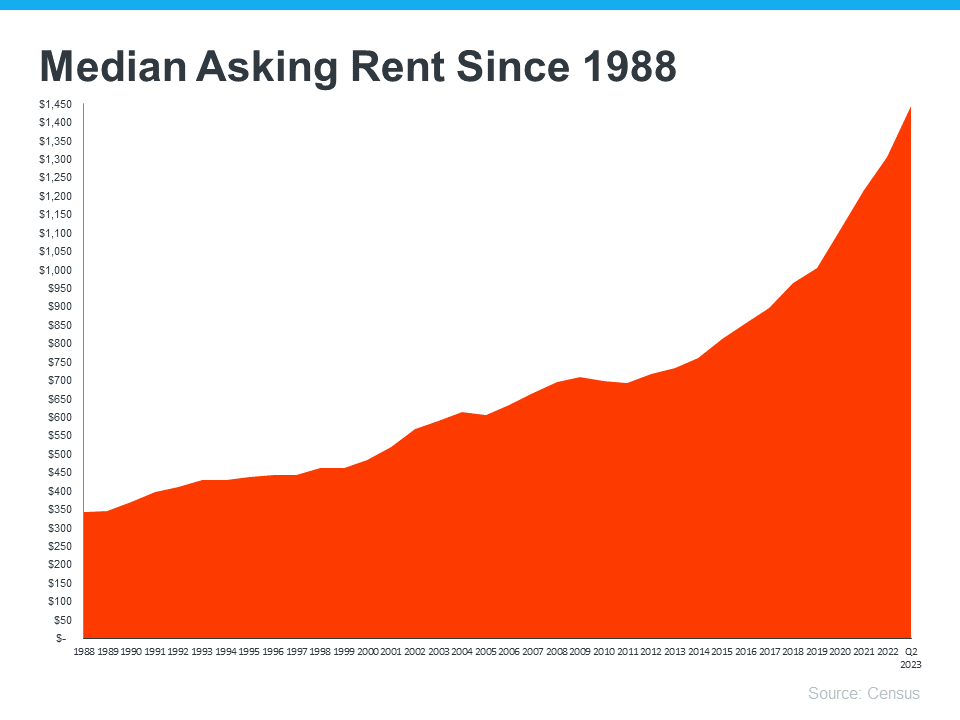

The graph below uses data from the Census to show how rents have been climbing steadily since 1988: Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this:

“. . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.”

According to AARP, buying your next home is a better long-term strategy than renting:

“Though each option has pros and cons, buying provides more pros, with a broader range of benefits.”

To help you choose what you’ll do after you sell, here are just a few of the benefits of homeownership that article covers:

If you're a baby boomer who’s wondering whether you should buy or rent your next home, let’s connect. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.