The Benefits of Using Your Equity To Make a Bigger Down Payment

Did you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity reaches a new height, the median down payment has too.

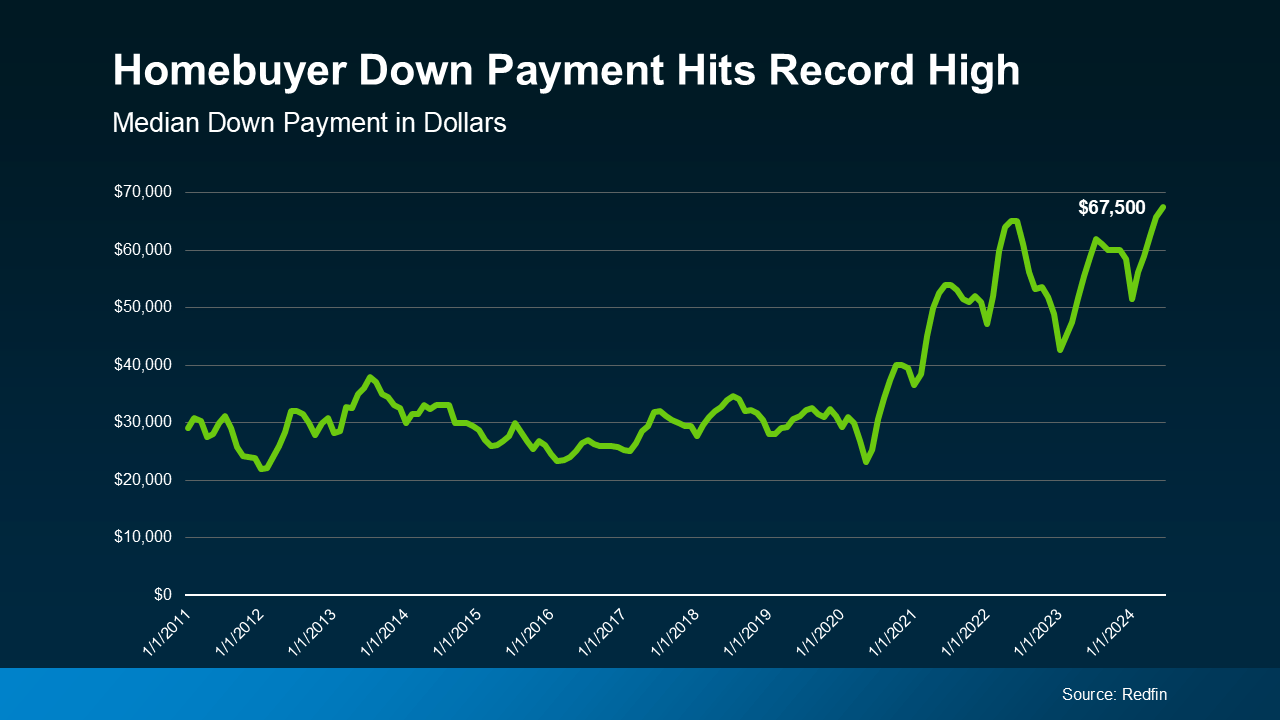

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—that’s nearly 15% more than last year, and the highest on record (see graph below):

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability.

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability.

Now, it’s important to remember you don’t have to make a big down payment to buy your next home—there are loan programs that let you put as little as 3%, or even 0% down. But there’s a reason so many current homeowners are opting to put more money down. That’s because it comes with some serious perks.

1. You’ll Borrow Less and Save More in the Long Run

When you use your equity to make a bigger down payment on your next home, you won’t have to borrow as much. And the less you borrow, the less you’ll pay in interest over the life of your loan. That’s money saved in your pocket for years to come.

2. You Could Get a Lower Mortgage Rate

Providing a larger down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage rate they’ll likely be willing to give you. And that amplifies your savings.

3. Your Monthly Payments Could Be Lower

A bigger down payment doesn’t just help you reduce how much you have to borrow—it also means your monthly mortgage payment may be smaller. That can make your next home more affordable and give you a bit more breathing room in your budget.

4. You Can Skip Private Mortgage Insurance (PMI)

If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an added cost many buyers have to pay if their down payment isn’t as large. Freddie Mac explains it like this:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

Avoiding PMI means you’ll have one less expense to worry about each month, which is a nice bonus.

Down payments are at a record high, largely because recent equity gains are putting homeowners in a position to put more money down.

If you’re thinking about selling your current house and moving, let’s work together to figure out how much home equity you have right now, and how it can boost your buying power in today’s market.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.