The Latest Builder Trend: Smaller, Less Expensive Homes

Even though affordability is improving, buying a home can still feel tough right now. But here’s some good news: builders are focusing their efforts on building smaller homes, and they’re offering key incentives to buyers. And both of these things can be a big help if you're worried about finding a home that’s right for your budget.

During the pandemic, homebuyers were looking for larger homes—and many could afford them. Builders responded to that demand and created bigger spaces to help people with things like working from home, setting up home gyms, and having extra rooms for virtual school.

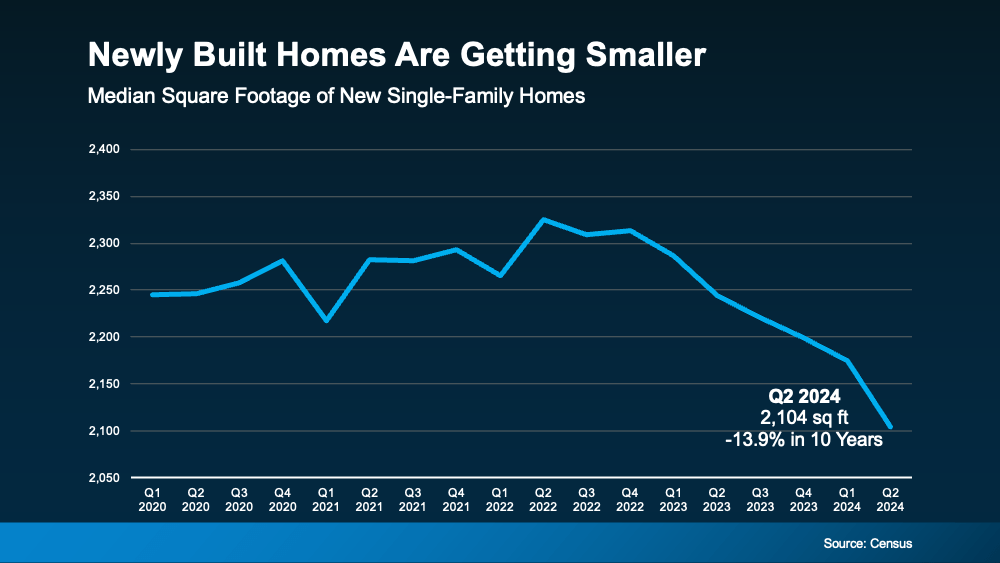

Now, with affordability as tight as it is, builders are turning their focus to smaller single-family homes. Data from the Census shows how significant this trend toward smaller new homes has been over the last couple of years (see graph below):

But why would builders want to build smaller homes right now? At the end of the day, builders are going to focus on building homes that meet current market demand – because they want to build what they know will sell. And the number one thing homebuyers are looking for right now is better affordability. Since smaller homes typically come with smaller price tags, both buyers and builders have shifted their focus to homes with less square footage. The National Association of Home Builders (NAHB) reports:

But why would builders want to build smaller homes right now? At the end of the day, builders are going to focus on building homes that meet current market demand – because they want to build what they know will sell. And the number one thing homebuyers are looking for right now is better affordability. Since smaller homes typically come with smaller price tags, both buyers and builders have shifted their focus to homes with less square footage. The National Association of Home Builders (NAHB) reports:

“. . . home buyers are looking for homes around 2,070 square feet, compared to 2,260 20 years ago.”

And according to Orphe Divounguy, Senior Economist at Zillow:

“Not only are cash-strapped buyers continually seeking out lower-cost options, but developers are changing what type and size of home they're producing to try and meet that need."

So, if you’re having a hard time finding something in your budget, it may be time to look at brand-new homes that have a smaller footprint. When you do, you may get a few other fringe benefits that can help on the affordability front – like price reductions or mortgage rate buy-downs.

According to the most recent data from Zonda, more than half of builders are offering incentives, some of which are mortgage rate buydowns. And those perks could help lower your future monthly housing payment too. John Burns, CEO of John Burns Research & Consulting, shares:

“The monthly payment matters more than anything else and builders have responded with smaller, more efficient homes.”

Not to mention, with new home construction, you’ll also get brand new everything, have fewer maintenance needs, and get some of the latest features available. That’s worth looking into, right?

With builders focusing on smaller homes, you may have more budget-friendly options when it matters most. If you're thinking about buying a home soon, let’s connect and see what’s available where you want to live.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.