Rising interest rates have begun to slow an overheated housing market as monthly mortgage payments have risen dramatically since the beginning of the year. This is leaving some people who want to purchase a home priced out of the market and others wondering if now is the time to buy one. But this rise in borrowing cost shows no signs of letting up soon.

Economic uncertainty and the volatility of the financial markets are causing mortgage rates to rise. George Ratiu, Senior Economist and Manager of Economic Research at realtor.com, says this:

“While even two months ago rates above 7% may have seemed unthinkable, at the current pace, we can expect rates to surpass that level in the next three months.”

So, is now the right time to buy a home? Anyone thinking about buying a home today should ask themselves two questions:

1. Where Do I Think Home Prices Are Heading?

There are two places to turn to answer this question. First is the consensus of what experts are saying. If you look at what experts are projecting for home prices in 2023, they’re forecasting home price appreciation around 2%. While it’s true some are calling for depreciation, most are calling for appreciation in home values over the next year.

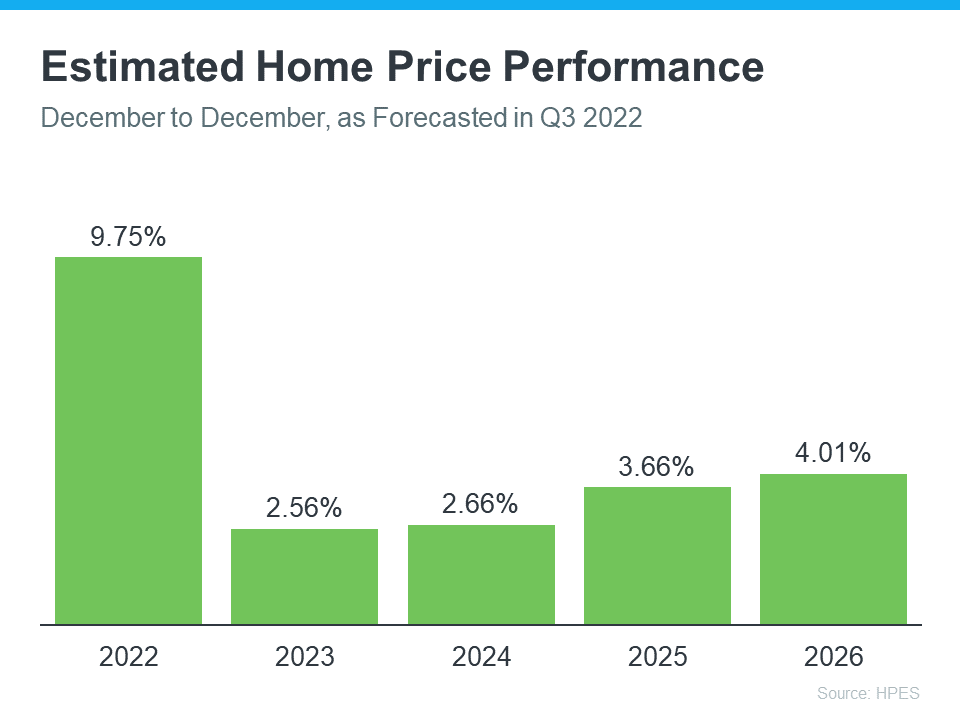

The second spot to turn to for information is the Home Price Expectation Survey from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists. According to the latest release, the experts surveyed are also calling for home price appreciation for the next several years (see graph below):

2. Where Do I Think Interest Rates Are Heading?

Like mentioned above, Ratiu sees mortgage rates rising over the next several months. Another expert agrees. Mark Fleming, Chief Economist at First American, says:

“While mortgage rates are expected to continue to drift higher over the coming months, much of the rapid increase in rates is likely behind us.”

The instability in the world and higher inflation are driving this volatile market, resulting in higher borrowing rates for those looking to buy homes.

Bottom Line

If you’re thinking about buying a home, asking yourself about home prices and mortgage rates will help you make a powerful and confident decision. Experts see both prices and rates rising in the future. The alternative is to rent, but rents are also increasing. That may mean buying a home makes more sense than renting.