Why a Foreclosure Wave Isn’t on the Horizon

Even though data shows inflation is cooling, a lot of people are still feeling the pinch on their wallets. And those high costs on everything from gas to groceries are fueling unnecessary concerns that more people are going to have trouble making their mortgage payments. But, does that mean there’s a big wave of foreclosures coming?

Here's a look at why the data and the experts say that’s not going to happen.

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even when they couldn’t show they’d be able to pay them back. At that time, lenders weren’t being as strict when looking at applicant credit scores, income levels, employment status, and debt-to-income ratio.

But since then, lending standards have gotten a whole lot tighter. Lenders became much more diligent when assessing applicants for home loans. And that means we’re seeing more qualified buyers who have less of a risk of defaulting on their loans.

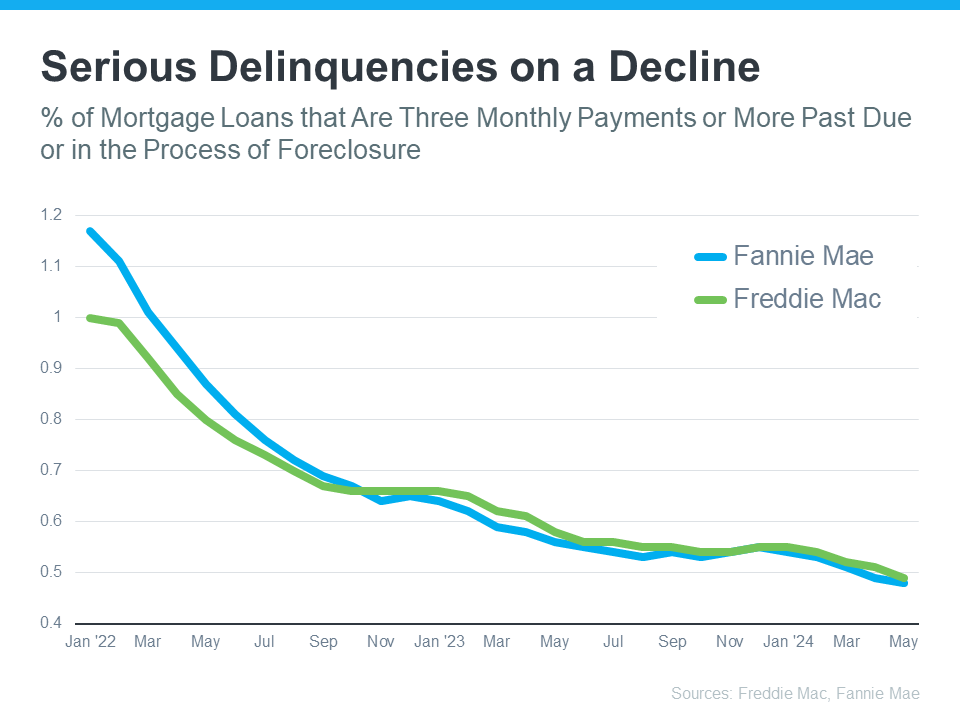

That’s why data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments (known in the industry as delinquencies) has been declining for quite some time. Take a look at the graph below:

What this means is that, not only are borrowers more qualified, but they’re also finding ways to navigate through their challenges, exploring their repayment options, or maybe even using the record amount of equity they have to sell and avoid foreclosure entirely.

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise significantly. But, since so many buyers are making their payments today and homeowners have so much equity built up, a wave of foreclosures isn’t likely.

Take it from Bill McBride of Calculated Risk – an expert on the housing market who, after closely following the data and market leading up to the crash, was able to see the foreclosure crisis coming in 2008. McBride says:

“We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.”

If you’re worried about a potential foreclosure crisis, know there’s nothing in the data to suggest that’ll happen. Buyers are more qualified now, and that’s one reason why they’re not falling seriously behind on their mortgage payments.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The Home Run Team, Ltd. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The Home Run Team, Ltd. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.