Why Buying Now May Be Worth It in the Long Run

Should you buy a home now or should you wait? That’s a question a lot of people have these days. And while what’s right for you is going to depend on a lot of different factors, here’s something you’ll want to consider as you make your decision.

As soon as you buy, you’ll start gaining equity. And you’d be surprised how quickly that can add up – even with more moderate home price appreciation.

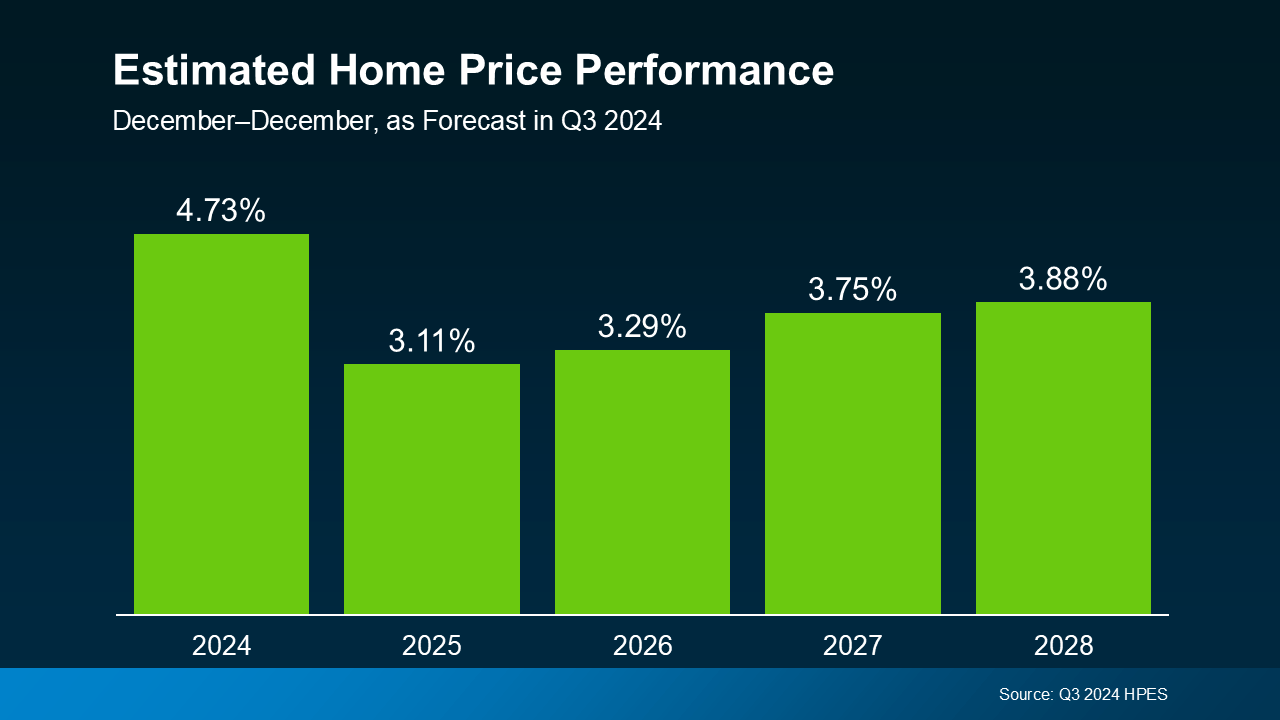

Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts project prices will continue to rise nationally through at least 2028 (see the graph below):

While home prices are going to vary from one local area to the next, this shows they’re expected to keep going up nationally. The size of the increase varies from year-to-year, but the important takeaway is that prices are forecast to rise every single year – just at a moderate pace.

While home prices are going to vary from one local area to the next, this shows they’re expected to keep going up nationally. The size of the increase varies from year-to-year, but the important takeaway is that prices are forecast to rise every single year – just at a moderate pace.

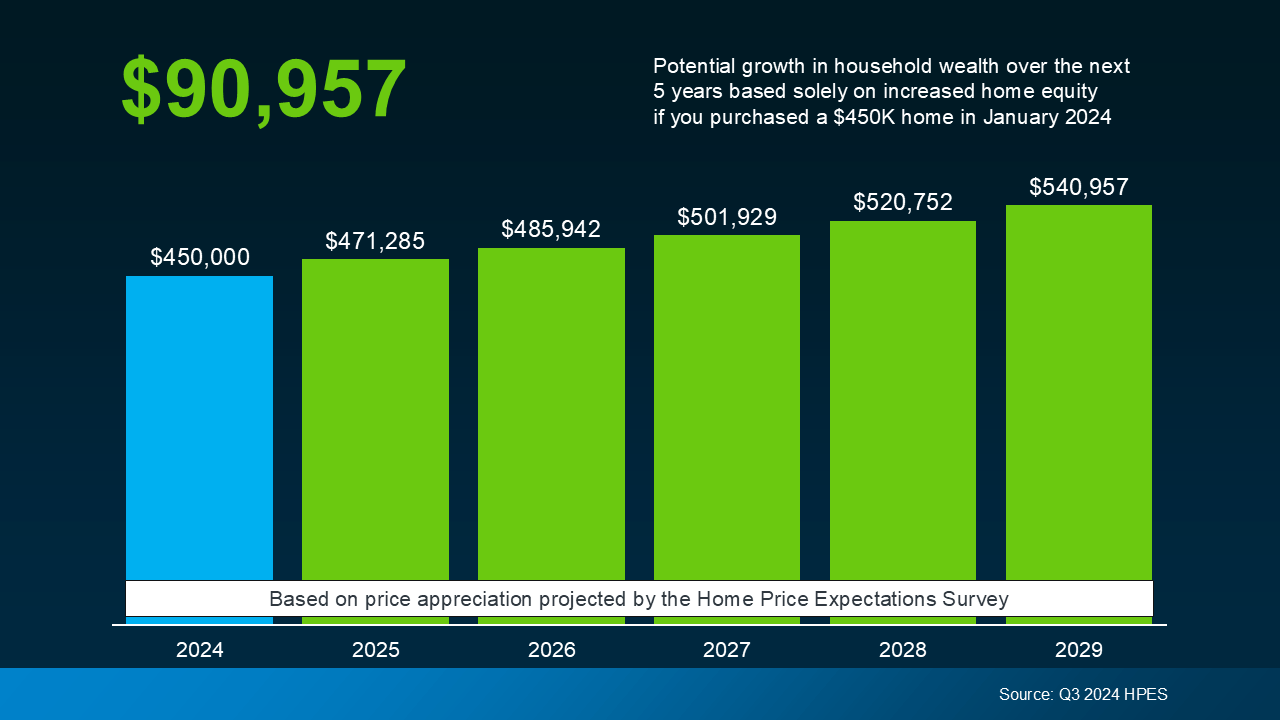

And while rising home prices may not sound great right now, once you own a home, that growth will be a big bonus for you. Here’s a look at what you stand to gain equity-wise once you buy. The graph below uses a typical home’s value and those HPES projections to show how much equity is at stake:

If you bought a $450,000 home at the beginning of this year, based on that starting value and the expert forecasts from the HPES, you could gain more than $90,000 in household wealth over the next five years. That’s significant.

If you bought a $450,000 home at the beginning of this year, based on that starting value and the expert forecasts from the HPES, you could gain more than $90,000 in household wealth over the next five years. That’s significant.

So, if you’re ready and able to buy, and growing your wealth is important to you, you’ve got an opportunity in front of you. And now that mortgage rates have fallen, it may be time to consider making a move.

To talk more about your options and what makes sense, lean on a pro. They’ll be able to tell you what home prices are doing in your area and what that means for your move (and your future equity). The Mortgage Reports says:

“Given the intricacies of the current market, it’s more important than ever to stay informed and up to date about housing market conditions. Whether you’re looking to buy or sell in the remaining months of 2024, having a professional guide you through the process can make all the difference.”

The decision to buy now or wait is a very personal one, but it’s valuable to have an expert’s perspective. They won't push you, but they will explain things you may not have considered, like the equity that’s at stake.

If you want help weighing your options and thinking through how the current market factors in, let’s connect.

There's a myth about down payments that hold a lot of buyers back; here's what to know to not get fooled.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s.

Right now, it's a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

Just because the economies down doesn't mean home prices will follow; in fact, it may be the opposite.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

Here’s the thing: the market’s shifting. And it might be time to hit play again.

If you put your home search on hold because you couldn't find anything you liked in your budget, it's time to try again.

Savvy sellers are jumping off the fence and back into the market. And here’s why.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you.

We're here to help people live wealthier lives and enjoy more freedom by educating and guiding them through their lifelong real estate journey. Whether you're buying a home, looking to sell or relocate, or are an investor, we can help you. No agents will work harder for you, because to us, going to bat for you, isn't work. That's just what you do when you're a team.